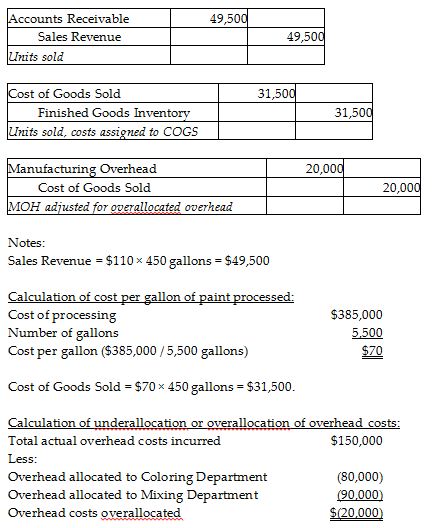

Magoro, Inc. has two processes—Coloring Department and Mixing Department. The company sold 450 gallons on account at $110 per gallon. The total cost of processing was $385,000 for 5,500 gallons of paint. Throughout the year, the company used a predetermined overhead allocation rate to allocate $80,000 and $90,000 of indirect costs to the Coloring Department and Mixing Department, respectively. The actual overhead costs incurred amounted to $150,000 at the end of the year.

What are the journal entries to record the sale of goods and the adjustment for over/underallocated manufacturing overhead at the end of the year if the company follows a perpetual inventory system and process costing?

You might also like to view...

List five disciplines of artificial intelligence

What will be an ideal response?

On the balance sheet, the amount accruing to a corporation's owners is referred to as

A) a liability. B) transfer price. C) an asset. D) stockholders' equity. E) return on investment.

Although we worked everyday on the proposal, we felt badly that we could not meet the May 15th deadline.

What will be an ideal response?

The Barden Corporation has the following equity accounts on its balance sheet: Common Stock ($1.25 par, 3,000,000 shares) $ 3,750,000 Contributed capital in excess of par 24,250,000 Retained earnings 153,600,000 Total common stockholders' equity $181,600,000 What is the maximum amount of dividends per share that may be paid by the Barden Corp if the capital impairment provisions of

state law are limited to the par value and the capital in excess of par accounts? A) $59.28 B) $51.20 C) $60.53 D) $8.08