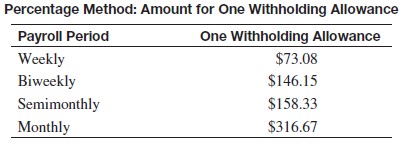

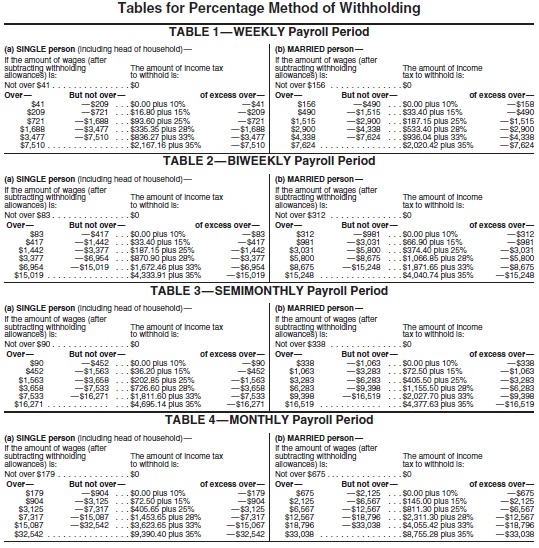

Use the percentage method of withholding to find the federal withholding tax, a 6.2% FICA rate to find the FICA tax, and 1.45% to find the Medicare tax. Then find the net pay for the employee. Assume that the employee has not earned over $115,000 so far this year.

Karen Smith has gross earnings of $7512.15 monthly. She is single and has 6 withholding allowances.

Karen Smith has gross earnings of $7512.15 monthly. She is single and has 6 withholding allowances.

A. $7,964.90

B. $5,910.04

C. $6,937.47

D. $6,484.72

Answer: B

Mathematics

You might also like to view...

Determine whether the series converges or diverges.

Figure 3.png)

Mathematics

Answer the question.Which of the following statements are true?I: If F1 and F2 are 5 dimensional flats in ?7, then the dimension of F1 ? F2 could have a dimension of 6.II: If F1 and F2 are strictly separated, then F1 ? F2 = ?.

A. I B. II C. Neither I or II D. Both I and II

Mathematics

Find the GCF for the list.36, 15

A. 15 B. 6 C. 3 D. 1

Mathematics

Solve.Manuel had $1478.65 in his checking account. He wrote checks of $43.85, $45.49, and $174.17 to pay some bills. He then deposited a paycheck of $792.23. How much is in his account after these changes?

A. $422.91 B. $2022.48 C. $2534.39 D. $2007.37

Mathematics