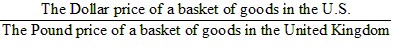

A basket of goods cost $100 in the U.S. and £65 in the United Kingdom. If purchasing power parity holds, what is the dollar-pound exchange rate?

What will be an ideal response?

We can answer this using the following equation: = Dollars per pound

= Dollars per pound

Substituting the information in the question, we divide $100 by £65 and the answer is $1.538/£.

You might also like to view...

Maryanne expects to work for another 30 years and expects to live another 10 years after she retires. If Maryanne completely smooths consumption over her lifetime, her marginal propensity to consume out of wealth is

A) 0.025. B) 0.033. C) 0.075. D) 0.10.

In the real business cycle model, a persistent increase in total factor productivity

A) increases the real wage and increases the price level. B) increases the real wage and decreases the price level. C) decreases the real wage and increases the price level. D) decreases the real wage and decreases the price level.

In the Stackelberg model, the leader has a first-mover advantage because it

A) has lower costs than the follower. B) commits to producing a larger quantity. C) reacts to the follower's decision. D) differentiates its output.

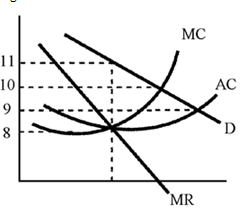

Figure 11-9

A. $1 B. $2 C. $3 D. $10