The property tax is the most important source of _____ government revenue.

A. federal

B. state

C. local

C. local

You might also like to view...

If Rick Nicotera maximizes his utility from a given income, the

a. marginal utility for every good he purchased would be the same b. marginal utility per dollar for all goods he purchased would be the same c. marginal utility per dollar for all goods he purchased would be at a maximum d. total expenditure he made on each good would be the same e. number of units of each good he consumes would be the same

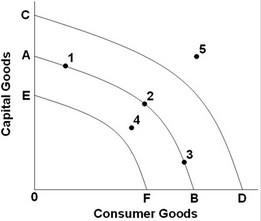

Refer to the above diagram. If the production possibilities curve of an economy shifts from AB to EF, it is most likely the result of what factor affecting economic growth?

Refer to the above diagram. If the production possibilities curve of an economy shifts from AB to EF, it is most likely the result of what factor affecting economic growth?

A. An efficiency factor. B. A demand factor. C. An allocation factor. D. A supply factor.

The 10% tax surcharge in 1968 did not have much effect on people's consumption because:

A. people knew the tax was temporary. B. people thought the tax was small. C. people knew the tax was permanent D. people thought the tax was for a good cause.

Utility is the benefit a consumer gets from consuming a good.

Answer the following statement true (T) or false (F)