A higher tax rate could result in lower tax revenues if:

A. attempts to avoid or evade taxes increase.

B. the tax has no incentive effects.

C. individuals switch from leisure to labor.

D. fewer people qualify for government assistance.

Answer: A

You might also like to view...

If the real interest rate is 7.5% and the rate of inflation is 3%, what is the nominal interest rate?

A. 4.50% B. 4.57% C. 10.50% D. 10.73%

A trade deficit means that net exports are positive

a. True b. False Indicate whether the statement is true or false

________ is the general resistance to change, often stemming from loss aversion.

A. Anchoring and adjustment B. Regression to the mean C. Status quo bias D. The present aim standard of rationality

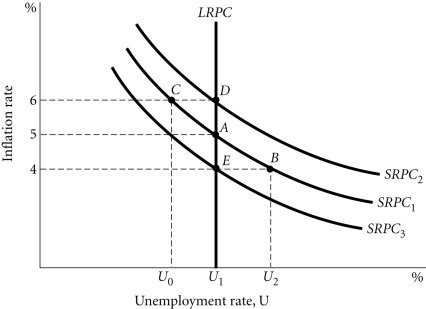

Refer to the information provided in Figure 28.7 below to answer the question(s) that follow. Figure 28.7Refer to Figure 28.7. Suppose the economy is at Point C. What can possibly move the economy to Point D?

Figure 28.7Refer to Figure 28.7. Suppose the economy is at Point C. What can possibly move the economy to Point D?

A. a leftward shift in the AD curve B. a leftward shift in the AS curve C. a rightward shift in the AD curve D. a rightward shift in the AS curve