The Fed sometimes acts as a lender of last resort. This means that

a. individuals can borrow from the Fed when the President declares a national disaster

b. individuals can try to borrow money from the Fed if they are unable to borrow from a bank

c. banks can always go to the Fed for reserves in order to purchase more government bonds

d. banks can always go to the Fed for reserves to meet their obligations to depositors

e. business firms can try to borrow money from the Fed they are unable to borrow from a bank

D

You might also like to view...

If the Fed wants to lower the U.S. exchange rate, what action should it take in the foreign exchange market? Why does the action lower the exchange rate?

What will be an ideal response?

Could either party do better?

a. Yes, both parties can do better without hurting each other if they cooperated b. Yes, one party can do better, but only at the expense of the other c. No, neither party can do better d. No, each party has its best possible outcome

The side of the market that will bear a greater share of the tax burden is the side that:

A. responds more to a change in prices. B. is more inelastic. C. changes quantity by a larger percentage when the price changes by a given percentage. D. bears the statutory burden of the tax.

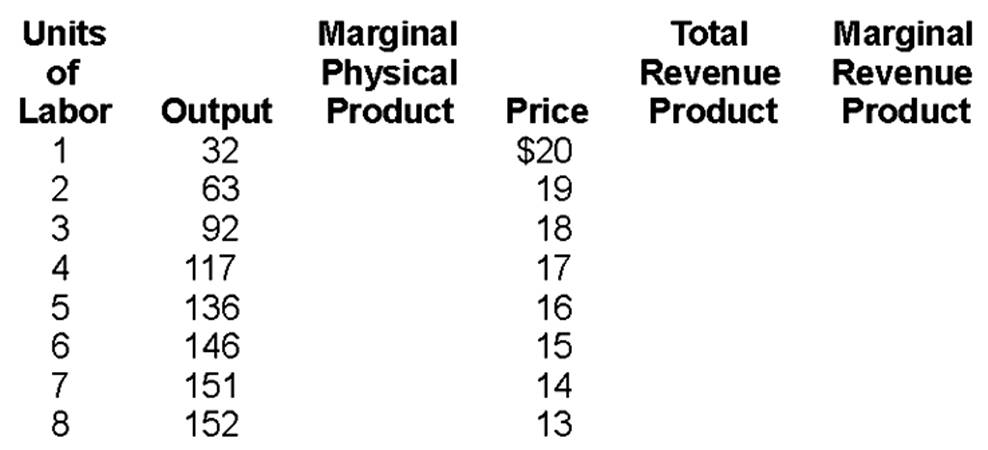

Fill in the above table.