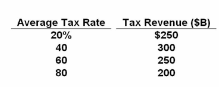

Refer to the table. If the current tax rate is 60 percent, supply-side economists would advocate:

A. lowering tax rates to 20 percent, or lower if possible.

B. lowering tax rates to 40 percent.

C. keeping tax rates at 60 percent.

D. raising tax rates to 80 percent.

B. lowering tax rates to 40 percent.

You might also like to view...

If net taxes paid by households increase:

A. transfer payments to households will decrease. B. private saving will decrease. C. private saving will increase. D. public saving will decrease.

Which of the following expresses 5.5%?

A. 0.0055 B. 0.550 C. 5.50 D. 0.0550

The demand curve shows the relationship between:

A. money income and quantity demanded. B. price and production costs. C. price and quantity demanded. D. consumer tastes and quantity demanded.

Which of the following describes that people cannot examine every possible choice available to them but instead use simple rules of thumb to sort among the alternatives that happen to occur to them?

A. normative economics B. ceteris paribus C. self-interest D. bounded rationality