What is the "chicken tax" and why did it come into existence?

What will be an ideal response?

Following World War II, in the interest of maintaining agricultural self-sufficiency, European nations imposed high tariffs on imported chickens, and U.S. chicken exports fell by 25%. In response, the U.S. imposed tariffs on four products that came predominantly from the European nations that had taxed U.S. chickens. Those retaliatory tariffs imposed by the United States became known as the "chicken tax."

You might also like to view...

An economist has conducted extensive research and has found that Jones Cola is a substitute for Tucker Cola. Ceteris paribus, the price of Jones Cola increases. The impact on the demand curve for Tucker Cola is a(n):

a. increase in demand. b. decrease in demand. c. increase in quantity demanded. d. decrease in quantity demanded.

A plumber quits his job in Dallas and moves to San Francisco where additional plumbers are needed, but it takes a couple of months for him to find a job. He is said to be:

A. Frictionally unemployed B. Structurally unemployed C. Cyclical unemployed D. Underemployed

Comparisons of GDP levels across countries are least accurate when:

A. prices differ across countries and nonmarket activities are a large part of total economic activity. B. purchasing power parity prevails. C. prices differ across countries. D. nonmarket activities are a small part of total economic activity.

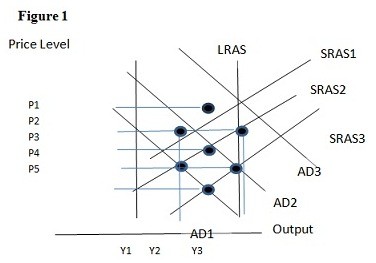

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.