Assume you pay a premium of $0.50/bu for a soybean call option with a strike price of $9.20/bu and that the current futures price is $8.90/bu. What is the option's current intrinsic value?

A. $0.50/bu

B. $0.30/bu

C. $0/bu

D. $-0.50/bu

Ans: C. $0/bu

You might also like to view...

If a new unit excise tax is levied on soft drinks, the

A. supply of soft drinks shifts to the left. B. supply of soft drinks shifts to the right. C. demand for soft drinks shifts to the left. D. demand for soft drinks shifts to the right.

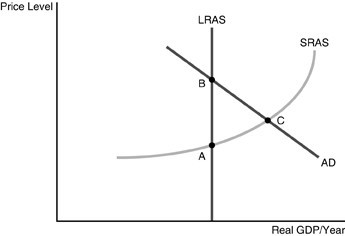

Refer to the above figure. If the economy is currently at point C, then an increase in taxes will lead to

Refer to the above figure. If the economy is currently at point C, then an increase in taxes will lead to

A. a decrease in real GDP and a decrease in the price level. B. a decrease in real GDP and an increase in the price level. C. a decrease in the price level and an increase in real GDP. D. an increase in the price level and an increase in real GDP.

Which of the following is FALSE regarding inelastic demand?

A. Price elasticity of demand is less than 1 (Ep < 1). B. If a firm raises price, total revenues will go up. C. If a firm lowers price, total revenues will fall. D. Price elasticity of demand is greater than 1 (Ep > 1).

In a monopolistically competitive market, entry into the industry

A. is relatively easy. B. is blocked. C. is as difficult as entry into a monopoly. D. is difficult due to extensive government regulation.