Calculate the total amount due to the IRS from the firm.The Book Mart collected $1,485.31 FICA, $347.37 medicare, and  federal withholding tax from employees.

federal withholding tax from employees.

A. $5,471.69

B. $3,986.38

C. $5,124.32

D. $3,639.01

Answer: A

You might also like to view...

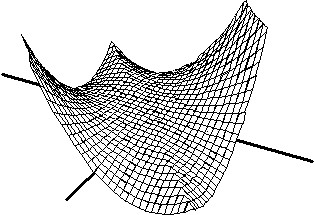

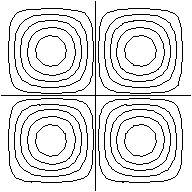

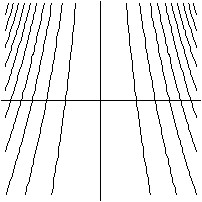

Match the surface show below to the graph of its level curves.

A.

B.

C.

D.

Find the volume of the solid generated by revolving the region bounded by the given lines and curves about the  . y = x2, y = 4, x = 0

. y = x2, y = 4, x = 0

A.  ?

?

B.  ?

?

C.  ?

?

D.  ?

?

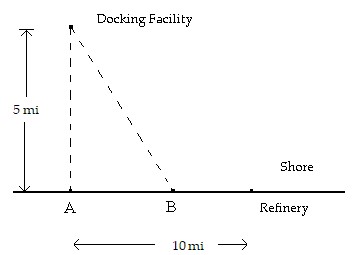

Solve the problem. Round to tenths where necessary.Supertankers off-load oil at a docking facility shore point 5 mi offshore. The nearest refinery is  east of the docking facility. A pipeline must be constructed connecting the docking facility with the refinery. The pipeline costs $300,000 per mile if constructed underwater and $200,000 per mile if over land.

east of the docking facility. A pipeline must be constructed connecting the docking facility with the refinery. The pipeline costs $300,000 per mile if constructed underwater and $200,000 per mile if over land. Locate point B to minimize the cost of construction.

Locate point B to minimize the cost of construction.

A. Point B is 6.91 miles from Point A. B. Point B is 3.27 miles from Point A. C. Point B is 4.47 miles from Point A. D. Point B is 4.28 miles from Point A.

Solve the problem.The function  can be used to determine the milligrams D of a certain drug in a patient's bloodstream h hours after the drug has been given. How many milligrams (to two decimals) will be present after

can be used to determine the milligrams D of a certain drug in a patient's bloodstream h hours after the drug has been given. How many milligrams (to two decimals) will be present after

A. 0.07 mg B. 4.76 mg C. 972.08 mg D. 0.49 mg