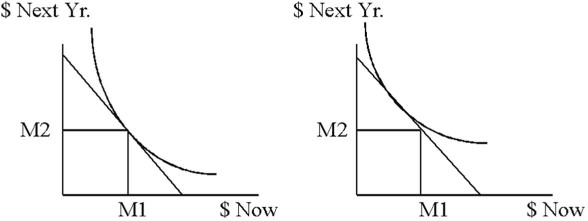

The graphs below show an economy of two people with identical incomes in two years. They have different preference patterns as shown.  Why is the market for loanable funds not in equilibrium?

Why is the market for loanable funds not in equilibrium?

What will be an ideal response?

The supply of loanable funds exceeds the demand since neither person wants to borrow and one person wants to save money.

You might also like to view...

A tariff is

a. a tax on financial transactions b. a tax on either imports or exports c. the result of a treaty d. a penalty imposed on importers of capital e. an agreement between countries to limit trade

Banks minimize the risk of loss to depositors by: a. lending to government officials

b. making many different loans to different borrowers. c. refusing to lend money to the U.S. government. d. lending to the richest 1 percent of the population. e. making very long-term loans.

When a U.S. importer needs $22,000 to settle an invoice for 25,520 Swiss francs, the exchange rate must be:

a. 1 Swiss franc = $1.16. b. 1 Swiss franc = $0.16. c. 1 Swiss franc = $0.84. d. $1 = 1.16 Swiss franc. e. $1 = 1.84 Swiss franc.

What is included in MB that is not included in either M1 or M2?

A. currency B. reserve deposits C. savings accounts D. checking accounts