The difference between the initial markup and maintained markup is based on _____

a. markdowns, added markups, shortages, and discounts

b. markdowns, shortages, and discounts

c. seasonality and style preferences

d. the need to match the prices of competitors

a

You might also like to view...

If a company actively tracks the satisfaction of its suppliers, banks, and distributors, it is using what is called a ________

A) customer-performance scorecard B) stakeholder-performance scorecard C) marketing balanced scorecard D) vendor scorecard E) generic scorecard

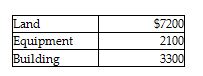

Anderson Company has purchased a group of assets for $23,800. The assets and their relative market values are listed below.

Which of the following amounts would be debited to the Land account? (Round any intermediate calculations to two decimal places, and your final answer to the nearest dollar.)

A) $4200

B) $13,566

C) $4046

D) $6188

The following amounts are from Silverton Co's 2014 income statement: Sales ................................................. $340,000 Sales returns and allowances .......................... 5,000 Cost of goods sold .................................... 132,000 Utilities expense ..................................... 66,000 Interest revenue ...................................... 1,000 Income tax on

operations .............................. 28,000 Extraordinary loss due to earthquake, net of tax ...... 5,000 Interest expense ...................................... 4,000 Salaries expense ...................................... 46,000 Loss on sale of investments ........................... 3,000 What amount would Silverton show for income from continuing operations on a multiple-step format income statement? a. $52,000 b. $68,000 c. $57,000 d. $96,000

A business is operating at 70% of capacity and is currently purchasing a part used in its manufacturing operations for $24 per unit. The unit cost for the business to make the part is $36, including fixed costs, and $28, not including fixed costs. If 15,000 units of the part are normally purchased during the year but could be manufactured using unused capacity, what would be the amount of

differential cost increase or decrease from making the part rather than purchasing it? A) $60,000 cost decrease B) $180,000 cost increase C) $60,000 cost increase D) $180,000 cost decrease