Identify and describe the measures retailers use to assess their financial performance.

What will be an ideal response?

Gross margin: Net sales ? COGS; GM% = GM$/Net sales

Operating profit margin: Gross Margin ? Operating Expenses-Extraordinary (recurring) operating expenses; Operating profit margin% = Operating profit margin$/Net sales

Net profit margin: Operating profit margin ? Extraordinary nonrecurring expenses-taxes-interest-depreciation; Net profit% = NP$/Net sales

You might also like to view...

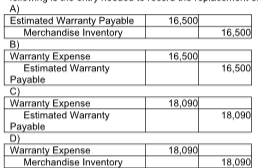

Masterpiece Sales Company offers warranties on all their electronic goods. Warranty expense is estimated at 3% of sales revenue. In 2019, the company had $603,000 in sales. In the same year, Masterpiece Sales replaced defective goods with goods that had a cost of $16,500. Which of the following is the entry needed to record the replacement of the defective goods?

Differentiate among the different types of short reports

Which of the following would be charged to the life tenant's interest in the course of administering a trust?

a. Expenses of selling a trust investment. b. The costs of establishing the trust. c. Ordinary repairs to trust property. d. Permanent improvements to the trust property.

Juniper Company uses a perpetual inventory system and the gross method of accounting for purchases. The company purchased $9,750 of merchandise on August 7 with terms 1/10, n/30. On August 11, it returned $1,500 worth of merchandise. On August 16, it paid the full amount due. The correct journal entry to record the purchase on August 7 is:

A. Debit Accounts Payable $9,750; credit Merchandise Inventory $9,750. B. Debit Merchandise Inventory $9,750; credit Accounts Payable $9,750. C. Debit Merchandise Inventory $9,750; credit Sales Returns $1,500; credit Cash $8,250. D. Debit Accounts Payable $8,250; debit Purchase Returns $1,500; credit Merchandise Inventory $9,750. E. Debit Merchandise Inventory $9,750; credit Cash $9,750.