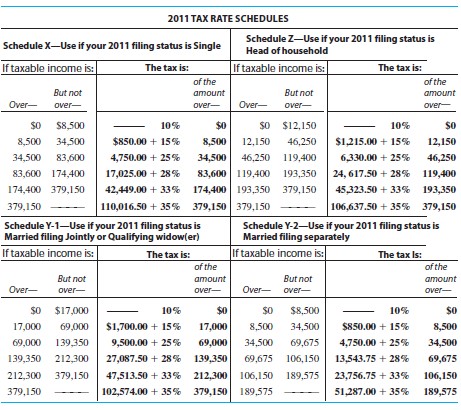

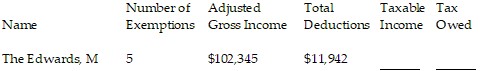

Find the amount of taxable income and the tax owed. The letter following the name indicates the marital status, and all married people are filing jointly. Use $3700 for each personal exemption; a standard deduction of $5800 for single people, $11,600 for married people filing jointly, $5800 for married people filing separately, and $8500 for head of a household; and the following tax rate schedule.

A. $87,045; $14,011.25

B. $72,245; $10,311.25

C. $71,903; $10,225.75

D. $86,703; $13,925.75

Answer: C

Mathematics

You might also like to view...

Provide an appropriate response.Under what conditions must the inequality symbol be reversed when solving an inequality?

What will be an ideal response?

Mathematics

Evaluate the logarithm without the use of a calculator.log9

A. 81 B. -81 C. -3 D. 3

Mathematics

Simplify.5(x + 4y + 7)

A. 5x - 20y - 35 B. 5x + 20y + 7 C. 5x + 20y + 35 D. 5x + 4y + 7

Mathematics

A committee is to consist of three members. If there are five men and six women available to serve on the committee, how many different committees can be formed?

a. 165 b. 10 c. 20 d. 33

Mathematics