When the Fed unexpectedly decreases the money supply,

a. real interest rates will rise and the foreign exchange value of the dollar will appreciate.

b. real interest rates will rise and the foreign exchange value of the dollar will depreciate.

c. real interest rates will fall and the foreign exchange value of the dollar will appreciate.

d. real interest rates will fall and the foreign exchange value of the dollar will depreciate.

A

You might also like to view...

Use the following table for a hypothetical single-product economy. year units of output price per unit price index (1=100) 1 10 10 100 2 12 20 200 3 15 30 300 4 20 40 400 Refer to the above data. Nominal GDP in year 4 is:

a) $320. b) $450. c) $225. d) $800.

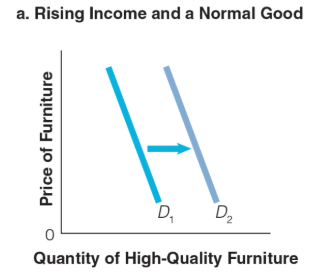

Which of the following would cause a shift of the demand curve to the right?

a. The price of a complement increases.

b. The number of buyers in a market decreases.

c. Tastes change against a good.

d. Future price increase is expected.

In theory, if a profit-maximizing firm in a perfectly competitive labor market found it advantageous to hire one less worker, the firm should pay a

A. higher wage rate to all previous workers hired. B. lower wage rate but only to the most recently hired workers. C. lower wage rate to all previous workers hired. D. higher wage rate but only to the most recently hired workers.

Someone who is an excellent salesperson will normally be less inclined to work for commissions than for a fixed salary.

Answer the following statement true (T) or false (F)