Which of the following programs would redistribute consumer surplus in favor of those with less surplus in an otherwise free market economy?

A. Providing welfare payments to the poor that are paid for by income taxes

B. Eliminating estate taxes

C. Ensuring that the market results in an efficient outcome

D. Enforcing existing property rights

Answer: A

You might also like to view...

One of the problems with official poverty statistics is that they

a. do not account for inflation. b. are not adjusted annually. c. omit in-kind transfers, such as food stamps. d. omit Medicare payments.

Depreciation refers to a decrease in the value of a durable good caused by: a. an increase in the price level. b. changes in the interest rate

c. wear and tear over time. d. changes in tax laws. e. a decrease in its resale value.

Describe the rationale behind supply and demand analysis for public goods

Please provide the best answer for the statement.

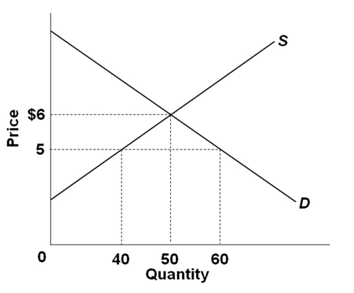

Refer to the graph below. If demand decreases, then total revenues will:

A. Decrease

B. Increase

C. Stay the same

D. Cause supply to decrease too