Bob Diener, an attorney working for the FBI in Santa Fe, earns $50,000 annually. Congress has imposed a 20 percent income tax. Assume Bob has an MPC of 0.8 . How much less will Bob consume than if no tax had been levied?

a. $12,000

b. $10,000

c. $8,000

d. $4,000

e. $2,000

C

You might also like to view...

The IS model implies that a dollar of government spending has a larger impact on equilibrium output than does a dollar of taxes. Explain

What will be an ideal response?

The income elasticity of demand is defined as the percentage change in quantity demanded divided by the percentage change in income

a. True b. False Indicate whether the statement is true or false

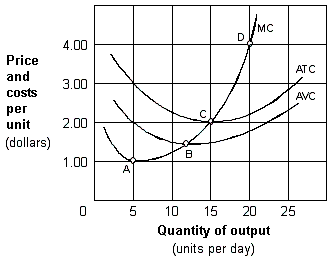

Exhibit 8-3 Cost per unit curves

A. $1.00 per unit (point A). B. $1.50 per unit (point B). C. $2.00 per unit (point C). D. $4.00 per unit (point D).

What do economies of scale, the ownership of essential raw materials, and patents have in common?

A. They are all barriers to entry. B. They all help explain why the long-run average cost curve is U-shaped. C. They all help explain why a monopolist's demand and marginal revenue curves coincide. D. They must all be present before price discrimination can be practiced.