Michael Woodford says the following is an advantage of interest-rate instruments for central banks

A) Conduct monetary policy without inflation.

B) Conduct monetary policy even if checking deposits pay interest at competitive rates.

C) Conduct monetary policy without government approval.

D) Conduct monetary policy with consumers in mind.

E) Conduct monetary policy with workers in mind.

B

You might also like to view...

Suppose there are 11 buyers and 11 sellers, each willing to buy or sell one unit of a good, with values {$14, $13, $12, $11, $10, $9, $8, $7, $6, $5, $4,}. Assume no transaction costs and a competitive market, what is the equilibrium price in this market?

a. 7 b. 8 c. 9 d. 10

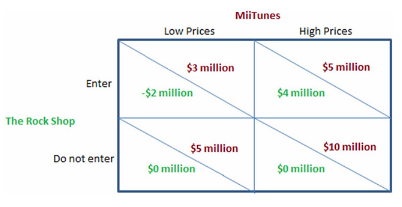

If MiiTunes and The Rock Shop are both in the music business and faced with the choices outlined in the figure shown, we can predict the outcome will be that:

This figure displays the choices and payoffs (company profits) of two music shops-MiiTunes and The Rock Shop. MiiTunes is an established business in the area deciding whether to charge its usual high prices or to charge very low prices, in the hopes that a new business will not be able to make a profit at such low prices. The Rock Shop is trying to decide whether or not it should enter the market and compete with MiiTunes.

A. MiiTunes charges low prices and The Rock Shop does not enter.

B. MiiTunes charges high prices and The Rock Shop enters.

C. MiiTunes charges high prices and The Rock Shop does not enter.

D. MiiTunes charges low prices and The Rock Shop enters.

Income elasticity measures the

A. Percentage change in quantity demanded given a percentage change in wealth. B. Responsiveness of quantity demanded to a percentage change in income. C. Way in which consumers switch from one product to another when price rises. D. Responsiveness of quantity demanded for one good to a percentage change in price of another good.

If a country has perfect income equality, the Gini coefficient is

A. 1. B. -1. C. 0. D. infinity.1