How do taxes and government cash transfer payments alter the measured distribution of income?

a. Taxes, because they are included in the official data on income distribution, are reflected in the data, but cash transfer payments, which redistribute income to lower income households, are not included.

b. Cash transfer payments are included in the official data on income distribution, but taxes are not.

c. Both taxes and cash transfer payments are included in the official data on income distribution

d. Neither taxes or cash transfer payments are included in the official data on income distribution

b

You might also like to view...

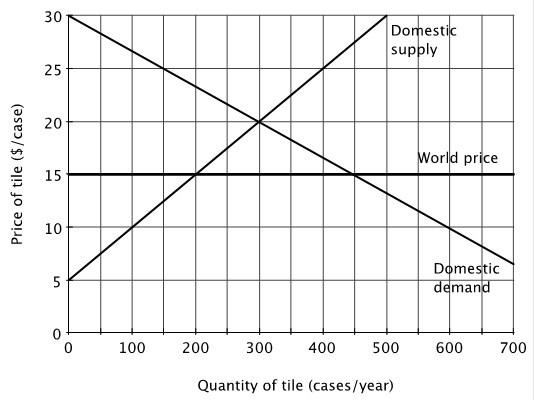

Relative to a closed economy, if Utopia opened itself to trade domestic tile producers would

A. produce 150 fewer cases of tile. B. produce the same amount of tile. C. produce 100 fewer cases of tile. D. produce 150 more cases of tile.

Five people want to have a lighted garden built at the entrance to their neighborhood. The difficulties they experience in getting one another to commit to paying for the garden are best described as

A) property rights. B) transactions costs. C) negative externalities. D) rivalry.

Which of the following statements about the circular flow model is false?

A) Consumers earn income by selling resources they own to businesses. B) Businesses supply goods and services to the household sector. C) Households supply resources to the business sector. D) Business firms buy goods and services from the household sector.

The marginal product is the incremental change in total output that can be obtained from the use of one more unit of an input in the production process, while varying all other inputs

a. True b. False Indicate whether the statement is true or false