Fiscal policy would be more effective if

A. potential income was unknown.

B. the government could change taxes and expenditures rapidly.

C. the size of the government debt didn't matter.

D. crowding out occurred more often.

Answer: B

You might also like to view...

If the state enacts the emission charge, find the associated cost savings to the firm, assuming the use of the old technology.

Consider the following abatement cost functions (TACO andMACO) for a firm using an old abatement (AO) technology: TACO = 1000 + 0.25(AO)2 MACO = 0.5(AO), where A isunits of abatement undertaken by the firm, and the cost values are in thousands of dollars. Further assume that the regulatory authority has set an abatement standard (AST) equal to 40 units for each firm and has proposed an emission charge implemented as a constant per unit tax (t) of $10 (i.e., MT = 10), where Total Tax = t(AST – Ai), and Ai is the existing abatement level.

In the above figure, CBL is the cost of breaking the law. If it is illegal to buy and sell, then the price per unit will be

A) $500. B) $400. C) $300. D) $200.

The U.S. and the Canadian currencies are the only two in the world that are called "dollars."

Indicate whether the statement is true or false

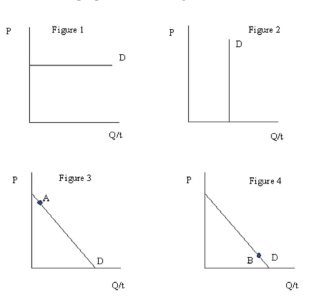

In Figure 3.1, if demand is considered perfectly inelastic, then the appropriate figure is?

a. Figure 1

B. Figure 2

c. Figure 3

d. Figure 4