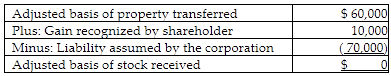

Ron transfers assets with a $100,000 FMV (basis $60,000) and $70,000 of business-related liabilities to a corporation in exchange for 100% of the corporation's stock with a FMV of $30,000. The corporation assumes the $70,000 mortgage. The transfer qualifies under Sec. 351. What is the adjusted basis of the stock received?

A) $0

B) $30,000

C) $60,000

D) $70,000

A) $0

The $70,000 of liabilities assumed by the corporation exceed the taxpayer's $60,000 adjusted basis in the property transferred so the taxpayer must recognize $10,000 of gain.

You might also like to view...

When bonds are sold for less than the face amount, this means that the

a. maturity value will be less than the face amount. b. maturity value will be greater than the face amount. c. bonds are sold at a premium. d. face rate of interest is less than the market rate of interest.

The amount of profit would always be equal to the ending cash balance

Indicate whether the statement is true or false

Division A produces a part with the following characteristics: Capacity in units 50,000 Selling price per unit$30 Variable costs per unit$18 Fixed costs per unit$3 Division B, another division in the company, would like to buy this part from Division A. Division B is currently purchasing the part from an outside source at $28 per unit. If Division A sells to Division B, $1 in variable costs can be avoided.Suppose that Division A has ample idle capacity to handle all of Division B's needs without any increase in fixed costs and without impacting sales to outside customers. From the point of view of Division A, any sales to Division B should be priced no lower than:

A. $18. B. $17. C. $30. D. $29.

Business publications are important to advertisers because

A. they provide an efficient way of reaching the specific types of individuals who constitute their target market. B. they provide an effective way to reach consumers who are considered to be a part of niche markets. C. they are generally the only health care information providers. D. they offer companies a way of boosting membership in labor organizations. E. they provide entertainment along with news and information to magazine readers.