A tax where wealthy people pay a larger percentage of their income than poor people is known as a(n):

a. excise tax.

b. flat tax.

c. proportional tax.

d. progressive tax.

e. regressive tax.

d

You might also like to view...

The term Ceteris paribus means that:

a. everything is changing. b. all other things remain unchanged. c. no one knows which variables will change and which will remain constant. d. the basic principle of economics do not apply to the case being considered.

You spend $20 to buy a used textbook at the college bookstore. What function does money perform here?

A) medium of exchange B) store of value C) unit of account D) standard of deferred payment

If Callum is consuming his utility maximizing bundle and the price of one good rises, what happens to the marginal utility per dollar spent on this good (MU/P), and what should Callum do?

A) MU/P has increased and Callum should buy more of this good. B) MU/P has increased and Callum should buy less of this good. C) MU/P has decreased and Callum should buy more of this good. D) MU/P has decreased and Callum should buy less of this good.

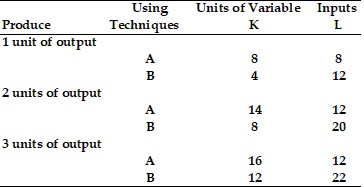

Refer to the information provided in Table 8.1 below to answer the question(s) that follow.

Table 8.1  Refer to Table 8.1. Assuming the price of labor (L) is $5 per unit and the price of capital (K) is $10 per unit, which of the following statements is true?

Refer to Table 8.1. Assuming the price of labor (L) is $5 per unit and the price of capital (K) is $10 per unit, which of the following statements is true?

A. The firm will use production technique B to produce the first two units of output and production technique A to produce the third unit of output. B. The firm will use production technique A to produce the first unit and production technique B to produce the second and third units of output. C. The firm will use production technique B to produce all three units of output. D. The firm will use production technique A to produce all three units of output.