Aggie, Inc Aggie, Inc purchased a truck at a cost of $12,000. The truck has an estimated salvage value of $2,000 and an estimated life of 5 years, or 100,000 hours of operation. The truck was purchased on January 1, 2011, and was used 27,000 hours in 2011 and 26,000 hours in 2012. Refer to Aggie, Inc's information presented above, what method of depreciation will maximize depreciation expense in

2011?

A) Straight-line

B) Double-declining-balance

C) Units-of-activity

D) All methods produce the same expense in 2011.

B

You might also like to view...

The primary purpose of ________ is to identify the range of possible brand associations in consumers' minds

A) experimental research B) dashboarding C) laddering D) semantic differentials E) word associations

When utilizing Facebook, how can businesses utilize a "soft sell" for merchandise?

A) By taking advantage of social media primetime B) By diversifying content C) By posting daily, but not excessively D) By being visual E) By keeping important posts in front of the audience

As a new manager of a production division, you have made the decision to incur more quality costs than the previous manager of the division incurred. How can you defend quality costs to executive management?

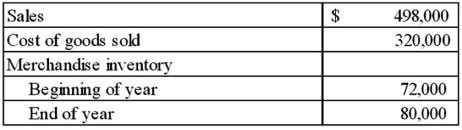

Selected financial information for Martin Company for Year 2 follows: Required:How many times did Martin's merchandise inventory turnover during Year 2? Round your answer to one decimal place.

Required:How many times did Martin's merchandise inventory turnover during Year 2? Round your answer to one decimal place.

What will be an ideal response?