An increase in taxes

a. raises aggregate expenditure by raising national income, thereby increasing consumption

b. raises aggregate expenditure by raising national income, thereby decreasing consumption

c. lowers aggregate expenditure by lowering national income, thereby increasing consumption

d. lowers aggregate expenditure by decreasing consumption, thereby lowering national income

e. has no effect on aggregate expenditure

D

You might also like to view...

The capital and financial account is the record of

A) the nation's imports and exports of capital goods. B) foreign investment in the nation minus the nation's investment abroad. C) a nation's international trading, borrowing, and lending. D) changes in the government's holdings of foreign currency. E) payments for imports, receipts for exports, net interest, and net transfers.

An increase in autonomous consumption means that

A) the consumption function shifts down. B) the consumption function shifts up. C) the consumption function becomes steeper. D) the consumption function becomes less steep.

If coal is extracted in an unsustainable manner in the current period, the price for steel is likely to increase in future

a. True b. False Indicate whether the statement is true or false

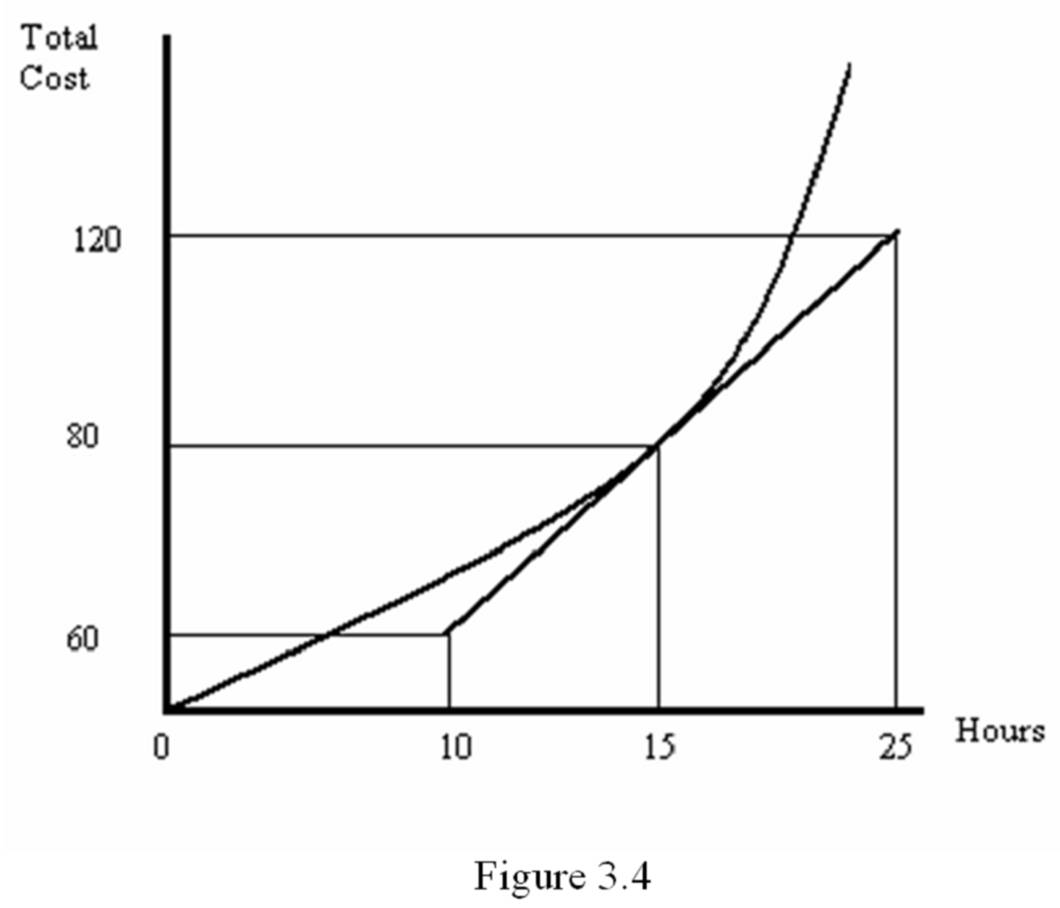

Refer to Figure 3.4. What is the marginal cost of the 15th hour spent on this activity?

A. $80

B. $5.33

C. $2.66

D. $4.00