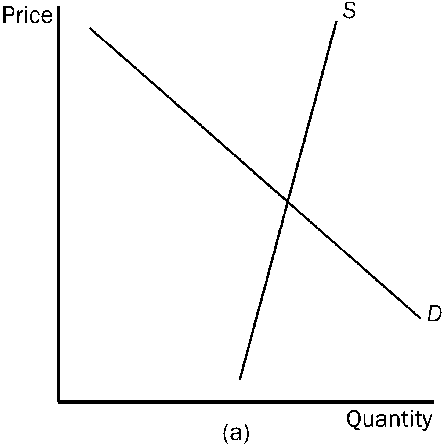

Figure 4-23

Refer to . In which market will the majority of the tax burden fall on the seller?

a.

market (a)

b.

market (b)

c.

market (c)

d.

All of the above are correct.

a

You might also like to view...

If the university administration plans to cut tuition charges in the hope of attracting more students and thereby increasing tuition revenues, we know

A) they are assuming an elastic demand. B) they are assuming an inelastic demand. C) they cannot succeed because of the law of demand. D) they must be running in the red. E) they will only succeed if more students can be enrolled at no cost.

Because of "mental accounting:"

A. people are better able to process price changes than changes in product sizes. B. people tend to be less risk averse. C. people pay too little on their monthly credit card bills. D. people isolate purchases and sometimes make irrational decisions.

The Federal Deposit Insurance Corporation

A. only insures deposits in money-center banks.

B.

| discourages banks from engaging in excessive risk taking. |

C. increases the stability of the banking system by reducing the likelihood of bank runs.

D. was established after the Panic of 1907.

Which of the following are not considered part of government purchases?

A) welfare benefits B) teachers' salaries paid by a local government C) a tank purchased by the federal government D) a bridge purchased by the state government