What is the amount of the acquisition differential amortization for 2018 (excluding goodwill impairment)?

On January 1, 2018, Hanson Inc. purchased 54,000 voting shares out of Marvin Inc.'s 90,000 outstanding voting shares for $240,000. On that date, Marvin's common shares and retained earnings were valued at $60,000 and $90,000, respectively. Marvin's book values approximated its fair values on the acquisition date with the exception of the company's equipment, which was estimated to have a fair value that was $50,000 in excess of its recorded book value. The equipment was estimated to have a useful life of eight years. Both companies use straight line amortization exclusively.

On January 1, 2019, Hanson purchased an additional 9,000 shares of Marvin Inc. on the open market for $45,000. On this date, Marvin's book values were equal to its fair values with the exception of the company's equipment, which is now thought to be undervalued by $60,000. Moreover, the equipment's estimated useful

life was revised to 5 years on this date.

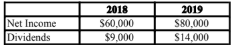

Marvin's net income and dividends for 2018 and 2019 are as follows:

Marvin's goodwill suffered an impairment loss of $5,000 during 2018. Hanson Inc. uses the equity method to account for its investment in Marvin Inc.

A) $6,250 B) $5,625 C) $12,000 D) $4,375

A) $6,250

You might also like to view...

____________ is a financial incentive awarded to employees for meeting certain goals or objectives.

a. Skill–based pay b. Job content-based pay c. Performance-based pay d. Seniority-based pay

A debtor may not convert a Chapter 7 case to a Chapter 11 or 13 case

a. True b. False Indicate whether the statement is true or false

A firm's operating breakeven point is the point at which ________

A) total operating costs equal total fixed costs B) total operating costs are zero C) EBIT is less than sales D) EBIT is zero

Best Buy has become the nation's largest specialty retailer by focusing on the customer's needs and wants. This philosophy is at the heart of a(n) _____ orientation.

A. sales B. market C. retail D. production E. exchange