Would a corporation seeking to raise capital sell its new shares on the stock market? If not, why not?

What will be an ideal response?

A corporation seeking to raise capital through the issuance of new stock rarely uses a stock market, as stock markets deal in previously issued, not new shares. A corporation seeking to raise capital by selling new stock would use the services of an investment bank, which deals in new shares of stock.

You might also like to view...

Physicians who own their own diagnostic testing facilities tend to order more tests, charge higher fees for them, and have higher total bills to patients. This practice of self-referral is an example of

a. moral hazard. b. adverse selection. c. resipsaloquitor. d. physician-induced demand. e. cognitive dissonance.

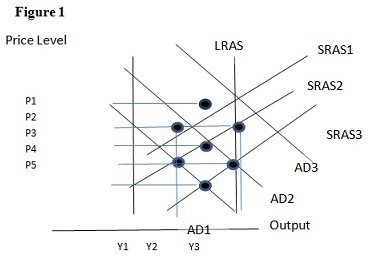

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD3 the result in the short run would be:

A. P1 and Y2. B. P2 and Y3. C. P3 and Y1. D. P2 and Y2.

The Aluminum Company of America (Alcoa) had a monopoly until the 1940s because

A) it was a public enterprise. B) it had a patent on the manufacture of aluminum. C) the company had a secret technique for making aluminum from bauxite. D) it had control of almost all the available supply of bauxite.

Suppose the United States eliminates high tariffs on German bicycles. As a result, we would expect:

A. the price of German bicycles to increase in the United States. B. employment to decrease in the German bicycle industry. C. employment to decrease in the U.S. bicycle industry. D. profits to rise in the U.S. bicycle industry.