Open Market Operations

The first tool of the Fed is the ability to buy and sell U.S. Treasury securities on the open market to expand or contract the monetary supply.

When the Fed buys securities the money supply expands. When the Fed sells securities the money supply contracts.

Think about which way the cash flows in the transaction, if the Fed buys it puts cash out into the market, if it buys it takes cash out of the market.

You might also like to view...

In the above table, between what two levels of output does one first observe the law of diminishing returns?

A) 0 and 1000 B) 1000 and 3000 C) 3000 and 4000 D) 4000 and 4500

All economists agree that the firm's only goal is to maximize profit

Indicate whether the statement is true or false

Consumption spending is $22 million, planned investment spending is $7 million, actual investment spending is $7 million, government purchases are $9 million, and net export spending is $3 million. the following is not true?

What will be an ideal response?

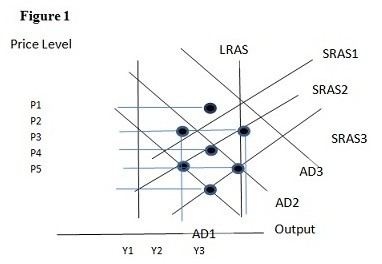

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the long run would be:

A. P1 and Y2. B. P2 and Y2. C. P3 and Y1. D. P2 and Y3.