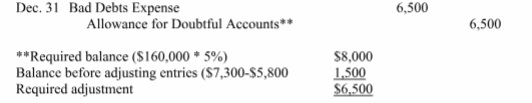

Prepare the necessary adjusting entries to record bad debts expense assuming this company's bad debts are estimated to equal 5% of accounts receivable.

At December 31 of the current year, a company reported the following:

Total sales for the current year: $980,000 includes $160,000 in cash sales

Accounts receivable balance at Dec. 31, end of current year: $160,000

Allowance for Doubtful Accounts balance at January 1, beginning of current year: $7,300 credit Bad debts written off during the current year: $5,800.

You might also like to view...

Current assets, other than cash, are expected to be sold or consumed are during a company's normal operating cycle

a. True b. False Indicate whether the statement is true or false

Direct marketing produced $2.05 trillion in sales in 2012, accounting for approximately 8.7 percent of GDP

Indicate whether the statement is true or false

The ____ function keeps track of your appointments

A) Contacts B) Notes C) Calendar D) All of the above

A single-channel queuing system has an average service time of 8 minutes and an average time between arrivals of 10 minutes. What is the hourly arrival rate?

A) 8 B) 6 C) 4 D) 2