Only the general partners have access to the books and records of the partnership

a. True

b. False

Indicate whether the statement is true or false

False

You might also like to view...

On July 1, 2019, Michigan Company has bonds with balances as shown below.

If the company retires the bonds for $74,150, what will be the effect on the income statement?

A) gain on retirement of $6950

B) loss on retirement of $6950

C) gain on retirement of $650

D) loss on retirement of $650

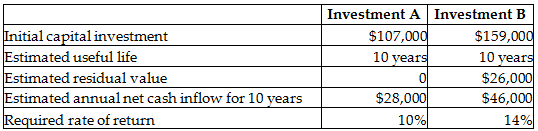

Calculate the payback period for Investment B. (Round your answer to two decimal places.)

Arrendo, Inc. is evaluating two possible investments in depreciable plant assets. The company uses the straight-line method of depreciation. The following information is available:

A) 3.46 years

B) 1.94 years

C) 2.89 years

D) 3.82 years

A company with working capital of $600,000 and a current ratio of 4:1 pays a $40,000 short-term liability. The amount of working capital immediately after payment is ________

a. $560,000 b. $640,000 c. $600,000 d. $520,000

Aviary, Inc. is considering a five-year project that has initial after-tax outlay or after-tax cost of $170,000. The future after-tax cash inflows from its project for years 1 through 5 are $45,000 for each year

Aviary uses the net present value method and has a discount rate of 11.25%. Will Aviary accept the project? A) Aviary accepts the project because the NPV is about $5,455. B) Aviary accepts the project because the NPV is about $165,275. C) Aviary rejects the project because the NPV is about -$4,725. D) Aviary rejects the project because the NPV is about -$154,725.