If the firm facing the demand curve P = 10 - Q has zero marginal costs and is a perfect price discriminator instead of a single price monopolist, and fixed costs are 12. What is the profit (loss) of the firm?

What will be an ideal response?

TR = 50 and TC = 12 so profit is 38

You might also like to view...

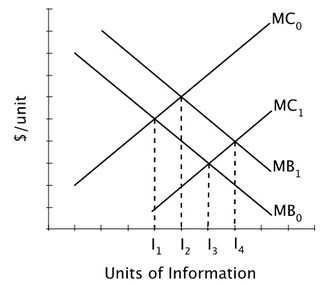

This graph illustrates the marginal costs and marginal benefits of acquiring information before making a major purchase. Suppose this graph describes a town in which the only way to gather any information about the good is through Consumer Reports. If the subscription price of Consumer Reports increases, then the impact of this could be portrayed by the marginal:

Suppose this graph describes a town in which the only way to gather any information about the good is through Consumer Reports. If the subscription price of Consumer Reports increases, then the impact of this could be portrayed by the marginal:

A. cost curve shifting from MC0 to MC1. B. benefit curve shifting from MB1 to MB0. C. cost curve shifting from MC1 to MC0. D. benefit curve shifting from MB0 to MB1.

J.T. Smith runs Game maker, an equipment producer for gaming service corporations. As CEO, Smith is seemingly worth $2.5 million per year in the marketplace. The directors are attempting to decide how to divide his compensation package between cash salary and perquisites. Using budget constraints and indifference curves, illustrate the potential outcomes for the board of directors.

What will be an ideal response?

If the four-firm concentration ratio for an industry is 84 percent, then

A) each of the firms account for 21 percent of total sales. B) the four largest firms in the industry account for 16 percent of the total sales. C) the four largest firms in the industry account for 84 percent of the total sales. D) the remaining firms in the industry accounts for 84 percent of the total sales.

The amount by which the burden of a tax exceeds the total revenue collected is called

A. undue burden. B. tax incidence. C. excess burden. D. neutrality.