Using Figure 9.1, explain what a firm would do in the short run if the market price of its product were at P4 and it produced Q4 . Is the firm earning an economic profit? Explain

What will be an ideal response?

The firm would continue to produce in the short run. The firm is enjoying pure economic profit since the price is above the average total cost of production.

You might also like to view...

Which of the following is a true statement about long-term care?

a. Over 20 percent of the elderly population currently live in nursing homes. b. There would be fewer residents of nursing homes if more people had long-term care insurance. c. Nursing homes are largely populated by elderly men. d. Almost one-half of all nursing home residents are over age 85. e. The cost of long-term care is funded primarily by private insurance.

When the Fed raises the discount rate, it:

A. lowers the cost of borrowing from the Fed, encouraging banks to make loans to the general public. B. raises the cost of borrowing from the Fed, discouraging banks from making loans to the general public. C. increases the amount of excess reserves that banks hold, encouraging them to make loans to the general public. D. increases the amount of excess reserves that banks hold, discouraging them from making loans to the general public.

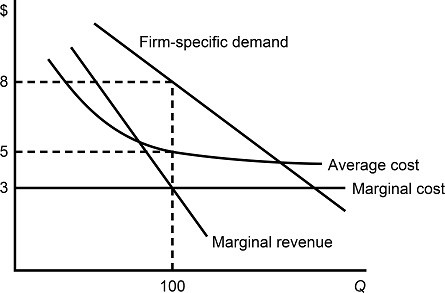

Figure 11.4Figure 11.4 depicts demand and costs for a monopolistically competitive firm. In the long run we expect:

Figure 11.4Figure 11.4 depicts demand and costs for a monopolistically competitive firm. In the long run we expect:

A. more firms to enter the market. B. the firm's demand curve to shift to the left. C. the firm's average cost of production to increase. D. All of these

Borrowing from other nations is necessary to finance

A. a foreign trade surplus. B. more exports than imports. C. a surplus in the current account. D. more imports than exports.