Individual income tax is the ________ single component of federal revenue

A) smallest B) least important C) second largest D) largest

D

You might also like to view...

If most workers are risk adverse why do we still see many workers agreeing to contracts where their compensation is variable like commissions for magazine salesmen or car salesmen?

What will be an ideal response?

Indifference curves are downward sloping because

A) when some of one good is taken away the consumer must be compensated with more of the other. B) higher prices mean less quantity demanded. C) higher indifference curves mean higher utility. D) Both A and B.

The Heckscher-Ohlin (H-O) theory suggests that research and development activity is most likely to be concentrated in countries which

A. are skilled-labor abundant. B. specialize in the production of primary commodities. C. are more self-reliant. D. are capital-abundant.

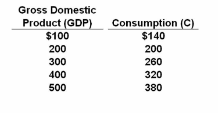

Refer to the data. A 10 percent proportional tax on income would:

Answer the question on the basis of the following before-tax consumption

schedule for an economy:

A. affect neither the size of the multiplier nor the stability of the economy.

B. increase the size of the multiplier and make the economy more stable.

C. increase the size of the multiplier and make the economy less stable.

D. reduce the size of the multiplier and make the economy more stable.