In the Solow growth model, from an initial steady state with fixed values of A, d, and n, an increase in the national saving rate causes the standard of living to

A) rise temporarily, and then fall back to its initial level.

B) rise and then hold constant at a new higher level.

C) grow at a slower rate temporarily, and then return to the initial growth rate.

D) grow at a permanently faster rate.

E) not change at all in the short run or the long run.

B

You might also like to view...

In 2010, a British Petroleum oil rig exploded in the Gulf of Mexico. The explosion resulted in a major oil spill and a decrease in the supply of oil. At the same time, the average price of gasoline decreased. Which of the following best explains the decrease in the price of gasoline?

A. The demand for gasoline increased, and the effect of the increase in demand on the gasoline price was less than the price effect of the decrease in supply. B. The quantity demanded of gasoline increased. C. The demand for gasoline remained unchanged. D. The demand for gasoline decreased, and the effect of the decrease in demand on the gasoline price was greater than the price effect of the decrease in supply.

Some electrical utilities are monopolies because of

A. diseconomies of scale. B. their inability to earn profits. C. ownership of resources without close substitutes. D. government restrictions that prevent new firms from entering the market.

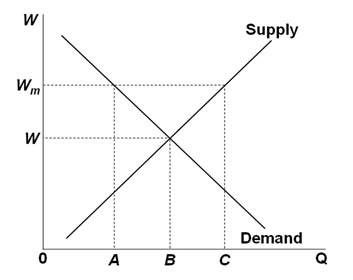

In the labor market shown below , if the demand for labor increases so that the equilibrium wage rate goes above the minimum wage Wm, then the minimum-wage law will:

A. Cause higher unemployment

B. Cause lower unemployment

C. Labor supply to decrease

D. Become ineffective in the market

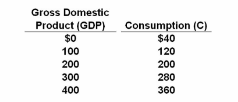

Refer to the data. If a lump-sum tax (the same tax amount at each level of GDP) of $40 is imposed in this economy, the marginal propensity to consume is:

Answer the question on the basis of the following before-tax consumption schedule for a closed economy:

A. .8 before taxes and .6 after taxes.

B. .8 both before and after taxes.

C. .6 before taxes and .8 after taxes.

D. .8 before taxes and .4 after taxes.