Which of the following is not a technology company, but used technology to revamp the business process of selling books?

A. Zappos

B. Netflix

C. Dell

D. Amazon

Answer: D

You might also like to view...

If a partner's capital balance is a debit after it has absorbed its share of the loss on realization, the balance is referred to as a deficiency

a. True b. False Indicate whether the statement is true or false

A(n) ________ is a statistical experimental design used to measure the effects of two or more independent variables at various levels and to allow for interactions between variables

A) multiple time series design B) posttest-only control group design C) factorial design D) one-shot case study E) interaction design

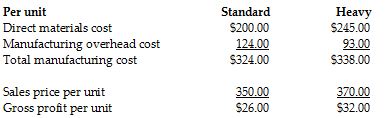

Compass Metal Bearings produces two sizes of metal bearings (sold by the crate)—standard and heavy. The standard bearings require $200 of direct materials per unit (per crate), and the heavy bearings require $245 of direct materials per unit. The operation is mechanized, and there is no direct labor. Previously Compass used a single plantwide allocation rate for manufacturing overhead, which was $1.55 per machine hour. Based on the single rate, gross profit was as follows:

Although the data showed that the heavy bearings were more profitable than the standard bearings, the plant manager knew that the heavy bearings required much more processing in the metal fabrication phase than the standard bearings, and that this factor was not adequately reflected in the single plantwide allocation rate. He suspected that it was distorting the profit data. He suggested adopting an activity-based costing approach.

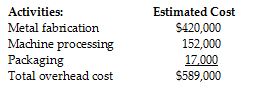

Working together, the engineers and accountants identified the following three manufacturing activities and broke down the annual overhead costs as shown below:

Engineers believed that metal fabrication costs should be allocated by weight and estimated that the plant processed 12,000 kilos of metal per year. Machine processing costs were correlated to machine hours, and the engineers estimated a total of 380,000 machine hours f

A factory supervisor's wages are classified as: Indirect laborFixed manufacturing overheadA)NoNoB)YesYesC)YesNoD)NoYes

A. Choice A B. Choice B C. Choice C D. Choice D