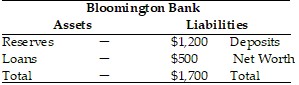

Refer to the information provided in Table 25.5 below to answer the question(s) that follow.

Table 25.5 Refer to Table 25.5. The required reserve ratio is 10%. If the Bloomington Bank is meeting its reserve requirement and has no excess reserves, its reserves equal

Refer to Table 25.5. The required reserve ratio is 10%. If the Bloomington Bank is meeting its reserve requirement and has no excess reserves, its reserves equal

A. $50.

B. $70.

C. $120.

D. $170.

Answer: C

You might also like to view...

What three effects can alter the aggregate demand curve?

What will be an ideal response?

The price level in the economy between 2014 and 2015 rose from 100 to 110. Between 2015 and 2016, the price level rose from 110 to 121. How does the short-run Phillips curve predict the unemployment rate will change as a result?

A) The unemployment rate will increase since inflation increased. B) The unemployment rate will decrease since inflation increased. C) The unemployment rate will decrease since inflation decreased. D) The unemployment rate will not change since there is no change in the rate of inflation.

Regional Bank is subject to a 10 percent required-reserve ratio. If this bank received a new checkable deposit of $1,000 . it could make new loans of

a. $100. b. $900. c. $1,000. d. $10,000.

During the great recession the Fed used many non-traditional tools to manage the money supply, including ______.

a. merging member banks b. eliminating interest payments on reserves held at the Fed c. quantitative easing d. lowering reserve requirements