Assume that foreign capital flows from a nation increase due to political uncertainly and increased risk. If the nation has highly mobile international capital markets and a fixed exchange rate system, what happens to real GDP and the monetary base in the context of the Three-Sector-Model?

a. Real GDP rises and monetary base rises

b. Real GDP rises and monetary base falls.

c. Real GDP and monetary base fall.

d. Real GDP and monetary base remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.C

You might also like to view...

If in the third quarter of 2016 total investment spending was $4,768 billion and depreciation was $3,292 billion, then net investment was equal to

A) $1,476 billion. B) $3,292 billion. C) $4,768 billion. D) $8,060 billion.

The total fixed cost remains constant as which of the following varies?

a. Cost of resources. b. Time. c. Output in a given period of time. d. Profit.

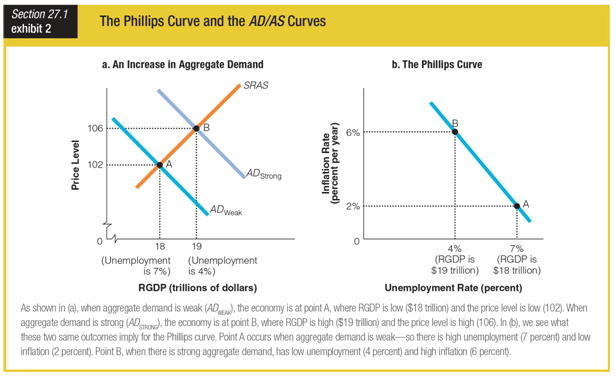

Based on the graphs for an increase in aggregate demand and the Phillips curve, we can see that when aggregate demand is strong, ______.

a. RGDP is low

b. unemployment is high

c. inflation is low

d. inflation is high

In the perfectly competitive market, all firms in the market are assumed to be producing:

A. identical products. B. differentiated products. C. products that are heavily advertised. D. complementary products.