Suppose that the supply of insulin is perfectly elastic and the demand for insulin perfectly inelastic. Then the result of an excise tax would be

A. a significant increase in government revenue and a significant decrease in the quantity consumed.

B. a significant decrease in the quantity consumed with no change in government revenue.

C. a significant increase in government revenue and no change in the quantity consumed.

D. no increase in government revenue and no change in the quantity consumed.

Answer: C

You might also like to view...

In the open-economy macroeconomic model, the key determinant of net capital outflow is the

a. nominal exchange rate. b. nominal interest rate. c. real exchange rate. d. real interest rate.

Crowding out is caused by

A. A decline in overall spending. B. A decline in tax revenues. C. An increase in government borrowing. D. An increase in consumer spending.

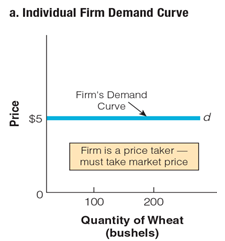

Judging from this graph, what would the individual firm charge if it increased its output to 400 bushels of wheat?

a. $3

b. $4

c. $5

d. $6

If the Federal Reserve wanted to increase the quantity of money, it would

A) tell the banks to lower interest rates. B) purchase government securities in the open market. C) convince the federal government to run a budget deficit. D) sell government securities in the open market.