Roberto and Reagan are both 25-percent owner/managers for Bright Light Inc. Roberto runs the retail store in Sacramento, CA, and Reagan runs the retail store in San Francisco, CA. Bright Light Inc. generated a $125,000 profit companywide made up of a $75,000 profit from the Sacramento store, a ($25,000) loss from the San Francisco store, and a combined $75,000 profit from the remaining stores. If Bright Light Inc. is an S corporation, how much income will be allocated to Roberto?

A. $75,000

B. $62,500

C. $125,000

D. $31,250

Answer: D

You might also like to view...

The World Trade Organization, which came into existence on January 1, 1995, is the successor of another organization with the abbreviation:

A) DSB. B) GATT. C) FTAA. D) NAFTA. E) ASEAN.

A ________________ allows the firm to eliminate a class of stock by paying the stockholders a specified amount

Fill in the blank(s) with correct word

Having similar ________ would allow tissues and organs to be transplanted easily.

A. cell recognition proteins B. carbohydrate chains in the cell membrane C. major histocompatibility complex proteins D. All of the choices are involved in tissue transplantation.

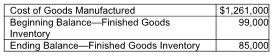

What is the cost of goods sold?

Viva, Inc. has provided the following information for the year:

A) $184,000

B) $1,275,000

C) $1,261,000

D) $1,247,000