Table 1.2 shows the hypothetical trade-off between different combinations of Stealth bombers and B-1 bombers that might be produced in a year with the limited U.S. capacity, ceteris paribus.Table 1.2Production Possibilities for BombersCombinationNumber of B-1 BombersOpportunity cost(Foregone Stealth)Number of Stealth BombersOpportunity cost (Foregone B-1)A20NA195 B35 180 C45 150 D50 100NAThe lowest opportunity cost in Table 1.2 for Stealth Bombers is

A. 10 B-1 bombers

B. 3 B-1 bombers

C. 2 B-1 bombers

D. 4 B-1 bombers

Answer: A

You might also like to view...

Which of the following is an argument that the incidence of corporate taxation falls entirely on consumers?

A) Corporations pass their tax burdens on to consumers by charging higher prices equal to the amount of the tax. B) Corporations pass their tax burdens on to consumers because consumers ultimately work for the corporations. C) Corporations always evade taxes so that consumers ultimately bear the tax burdens as taxpayers. D) Most taxes on consumers are collected by corporations through sales taxes.

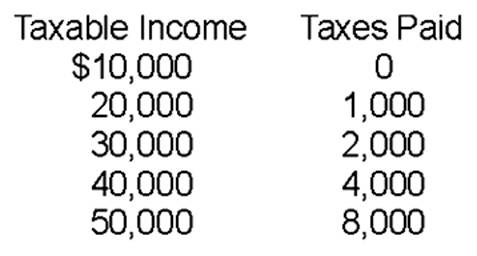

The tax represented here is

A. progressive.

B. proportional.

C. regressive.

D. None of these choices

Answer the following questions:

a. If aggregate expenditures falls by $5 million, and the MPC is 0.80, explain the process that will drive the economy to a new equilibrium level. b. What will be the final result of this initial change?

Which statement is true?

A. Income is fairly evenly distributed in the U.S. B. The richest 1% of our population has nearly 50% of the income. C. The percentage of Americans below the poverty line has been falling steadily (except for recession) since the 1950s. D. Eleven percent of the children under six living in a two parent home are poor.