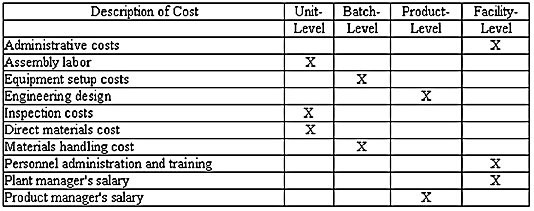

Classifying costs into one of four hierarchical levels can facilitate the identification of relevant costs. Place an "X" in the appropriate column to classify the following costs as Unit-level, Batch-level, Product-level, and Facility level.

What will be an ideal response?

You might also like to view...

Complete Electronics Inc. sells a point-of-sale computer with a two-year service contract. Complete collects $3,000 cash for the selling price of the computer and $576 for the two-year service contract. How is revenue recognized?

A) Complete will record Sales Revenue of $3,576 when the computer is delivered to the customer. B) Complete will record Sales Revenue of $1,788 per year for two years. C) Complete will record Sales Revenue of $3,000 when the computer is delivered and Service Revenue of $24 per month for 24 months. D) Complete will record Sales Revenue of $3,000 when the computer is delivered and will record revenue for the service contract as service calls are made.

Which of the following use human editors to categorize and evaluate websites, blogs and podcasts?

A) Metasearch engines B) Deep Internet C) Online databases D) Web directories E) Research librarians

Answer the following statements true (T) or false (F)

1. Earnings per share for income from continuing operations must be reported on the face of the income statement. 2. When computing earnings per share, preferred dividends are subtracted from net income because the preferred stockholders have the first claim to dividends. 3. Earnings per share reports the amount of net income (loss) for each share of the company's issued common stock. 4 Companies can report a negative amount in retained earnings. 5. Companies usually report their retained earnings restrictions on the balance sheet.

Which of the following reflects the effect of the year-end adjusting entry to record estimated uncollectible accounts expense using the allowance method? Assets=Liab.+Stk.EquityRev.?Exp.=Net Inc.Stmt of CashFlowsA.- NA -NA - -?OAB.NA - -NA + -NAC.NA - -NA + -?OAD.- NA -NA + -NA

A. Option A B. Option B C. Option C D. Option D