If U.S. residents purchase $600 billion worth of foreign assets and foreigners purchase $300 billion worth of U.S. assets,

a. U.S. net capital outflow is $300 billion; capital is flowing into the U.S.

b. U.S. net capital outflow is $300 billion; capital is flowing out of the U.S.

c. U.S. net capital outflow is -$300 billion; capital is flowing into the U.S.

d. U.S. net capital outflow is -$300 billion; capital is flowing out of the U.S.

b

You might also like to view...

An underground economy:

a. is a market where transaction occurs under the ground. b. is a market where the buyers and sellers make transactions without the government’s approval. c. is a market where the buyers and sellers make transactions with the government’s approval. d. is a market that is international in scope and fully authorized to conduct business.

Theoretically, when a currency depreciates one can predict that

a. the price level will rise and real GDP will rise. b. the price level will fall and real GDP will fall. c. real GDP will rise, but price change is not predictable. d. the price level will rise, but real GDP change is not predictable.

Which of the following best describes the relationship between economic freedom and real per capita Gross Domestic Product (GDP)?

A) As economic freedom increases, real per capita GDP decreases. B) As economic freedom increases, real per capita GDP increases. C) As economic freedom decreases, real per capita GDP increases. D) There are too many extraneous factors involved to discern a direct relationship.

Refer to the information. If the price of product A is $0.50, the firm will realize:

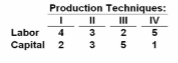

Answer the question on the basis of the following information: Suppose 30 units of product A can be produced by employing just labor and capital in the four ways shown below. Assume the prices of labor and capital are $2 and $3 respectively.

A. an economic profit of $4.

B. an economic profit of $2.

C. an economic profit of $6.

D. a loss of $3.