Tradable emissions permits are used to:

a. reduce sulfur dioxide emissions by requiring firms to pay a pollution tax.

b. encourage firms to reduce sulfur dioxide emissions by allowing the sale of excess permits.

c. decrease consumption as the producer passes the full cost of the permit onto the consumer.

d. impose a tax on SO2 emissions that is paid by the firm and is a source of tax revenues for the federal government.

Ans: b. encourage firms to reduce sulfur dioxide emissions by allowing the sale of excess permits.

You might also like to view...

The merchandise trade balance does not include

a. exports of refrigerators b. imports of automobiles c. exports of agricultural products d. shipping and insurance costs e. imports of food items with heavy tariffs

If the government levies a $500 tax per car on sellers of cars, then the price received by sellers of cars would

a. decrease by less than $500. b. decrease by exactly $500. c. decrease by more than $500. d. increase by an indeterminate amount.

Past expenses are irrelevant to supply decisions because

What will be an ideal response?

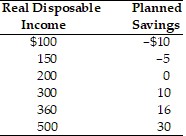

According to the above table, as the level of real disposable income decreases

According to the above table, as the level of real disposable income decreases

A. the APS decreases. B. the marginal propensity to consume decreases. C. the marginal propensity to save increases. D. the APS increases.