Which of the following conclusions about supply-side tax initiatives is accepted by most economists?

a. Supply-side tax cuts are likely to benefit the poor as much as the rich.

b. Supply-side tax cuts will almost certainly lead to smaller budget deficits.

c. Such tax cuts probably will increase aggregate supply quickly, but an increase in aggregate demand will come later.

d. Tax reductions aimed at stimulating business investment are likely to have a greater impact than tax reductions aimed at getting people to work longer hours or save more.

d

You might also like to view...

Full employment is the situation in which the economy operates at an unemployment rate equal to the sum of:

a. structural and frictional unemployment. b. cyclical and frictional unemployment. c. structural and cyclical unemployment. d. structural, frictional, and cyclical unemployment.

The more widely held and accepted credit cards are, the more money people would be expected to hold in the form of currency

a. True b. False Indicate whether the statement is true or false

If the demand for bananas is elastic, then an increase in the price of bananas will

a. increase total revenue of banana sellers. b. decrease total revenue of banana sellers. c. not change total revenue of banana sellers. d. There is not enough information to answer this question.

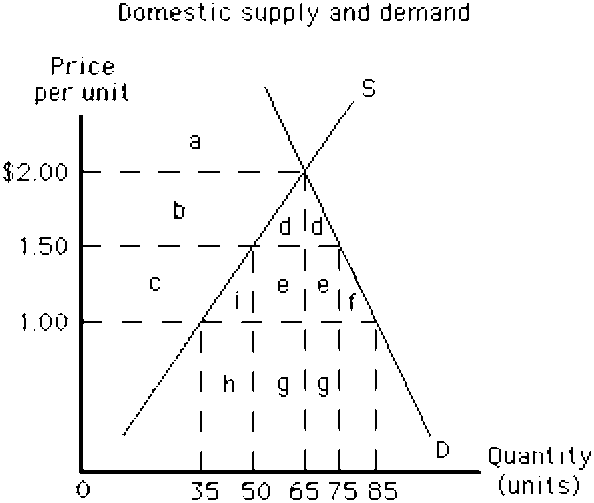

Figure 17-12

If the country illustrated in is initially trading without restrictions at a world price of $1.00, the gain in producer surplus as a result of a tariff of $0.50 per unit is represented by area

a.

c + h

b.

h

c.

c

d.

c + g

e.

g