Management and a labor union are bargaining over how much of a $100 surplus to give to the union. The $100 is divisible up to one cent. The players have one shot to reach an agreement. Management has the ability to announce what it wants first, and then the labor union can accept or reject the offer. Both players get zero if the total amounts asked for exceed $100. Which of the following is NOT a Nash equilibrium?

A. Neither management requesting $100 and the labor union accepting $0 nor management requesting $70 and the labor union accepting $20 are Nash equilibria.

B. Management requests $70 and the labor union accepts $20.

C. Management requests $50 and the labor union accepts $50.

D. Management requests $100 and the labor union accepts $0.

Answer: B

You might also like to view...

If there is a decrease in foreign demand for U.S. goods due to a recession in Europe

A) the U.S. aggregate demand will shift right. B) the U.S. aggregate demand will shift left. C) the U.S. aggregate demand will not be affected. D) the U.S. aggregate demand will become steeper.

One uniquely American aspect of central banking is that: a. the United States has 12 central banks rather than one

b. the Federal Reserve is a private institution with no governmental supervision. c. the dual banking system created two parallel central banks. d. the U.S. Treasury runs the Federal Reserve as an extension of the Executive Branch.

To avoid a coordination failure, the intentions of savers and investors must be both

a. increasing. b. at their planned levels. c. more than full employment GDP. d. at levels set by the government.

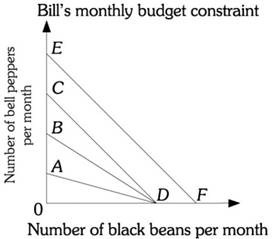

Refer to the information provided in Figure 6.6 below to answer the question(s) that follow. Figure 6.6Refer to Figure 6.6. Bill's budget constraint is BD. Bill's income is $600, the price of a bell pepper is $1, and the price of a bag of black beans is $2. At point D Bill is buying ________ bell peppers and ________ bags of black beans.

Figure 6.6Refer to Figure 6.6. Bill's budget constraint is BD. Bill's income is $600, the price of a bell pepper is $1, and the price of a bag of black beans is $2. At point D Bill is buying ________ bell peppers and ________ bags of black beans.

A. 600; 0 B. 300; 150 C. 600; 300 D. 0; 300