What does the law of diminishing returns imply for the shape of the marginal cost curve?

What will be an ideal response?

The law of diminishing returns states: As a firm uses more of a variable factor of production, with a given quantity of the fixed factor of production, the marginal product of the variable factor eventually diminishes. The law of diminishing returns means that each additional worker produces a successively smaller addition to output. So to get an additional unit of output, ever more workers are required. The cost of an additional unit of output—marginal cost—is increasing, so the marginal cost curve eventually slopes upward.

You might also like to view...

Everything else held constant, a balanced budget increase in government spending (that is, an increase in government spending that is matched by an identical increase in net taxes) will

A) increase aggregate demand, but not by as much as if just government spending increases. B) increase aggregate demand by more than if just government spending increases. C) not affect aggregate demand. D) decrease aggregate demand.

A consumer values a house at $525,000 and a producer values the same house at $485,000 . If the transaction is completed at $510,000 . what amount of tax will result in unconsummated transaction?

a. A tax of $9,000 b. A tax of $14,000 c. A tax of $15,000 d. A tax of $18,000

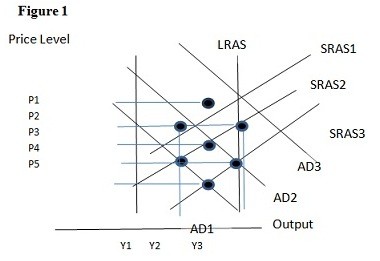

Using Figure 1 above, if the aggregate demand curve shifts from AD3 to AD2 the result in the long run would be:

A. P1 and Y2. B. P2 and Y1. C. P3 and Y1. D. P3 and Y2.

Which of the following will not shift the aggregate demand curve to the right?

A. consumers becoming more optimistic about the future B. an increase in government spending C. business optimism increases D. consumers become pessimistic about the future