Fetzer Company declared a $0.25 per share cash dividend. The company has 360,000 shares authorized, 342,000 shares issued, and 14,400 shares in treasury stock. The journal entry to record the dividend declaration is:

A. Debit Retained Earnings $81,900; credit Common Dividends Payable $81,900.

B. Debit Common Dividends Payable $81,900; credit Cash $81,900.

C. Debit Retained Earnings $90,000; credit Common Dividends Payable $90,000.

D. Debit Common Dividends Payable $85,500; credit Cash $85,500.

E. Debit Retained Earnings $85,500; credit Common Dividends Payable $85,500.

Answer: A

You might also like to view...

Discuss the concept of disintermediation and provide an example

What will be an ideal response?

What positive correlation appeared within the evidence of the ERC survey into organizational culture at for-profit organizations?

a. strong ethical culture and lower levels of misconduct b. strong ethical culture and higher levels of misconduct c. weaker ethical culture and lower levels of retaliation for reporting misconduct d. strong-leaning ethical culture and higher levels of retaliation for reporting misconduct

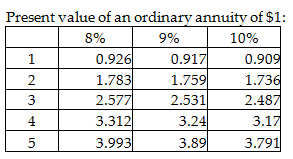

Odeletta Corporation is considering an investment of $518,000 in a land development project. The investment will yield cash inflows of $220,000 per year for five years. The company uses a discount rate of 9%. What is the net present value of the investment?

A) $238,280

B) $337,800

C) $341,880

D) $220,000

The price of an S&P 500 Index futures contract is $988.26 when you decide to enter a long position. When the position is closed the futures price is $930.32

If there are no settlement requirements, what is your dollar gain or loss? (Ignore opportunity costs.) A) $14,485 loss B) $14,485 gain C) $57.94 loss D) $57.94 gain