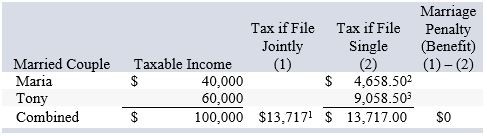

Maria and Tony are married. They are preparing to file their 2019 tax return. If they were to file as single taxpayers, Maria and Tony would report $40,000 and $60,000 of taxable income, respectively. On their joint tax return, their taxable income is $100,000. How much of a marriage penalty or benefit will Maria and Tony experience in 2019? (Use Tax rate schedules.)

What will be an ideal response?

No marriage penalty or benefit.

Answer computed as follows:

1. $9,086 + 22% × ($100,000 ? $78,950) = $13,717

2. $4,543 + 22% × ($40,000 ? $39,475) = $4,658.50

3. $4,543 + 22% × ($60,000 ? $39,475) = $9,058.50

You might also like to view...

Cognitive structures used for organizing new information are known as ______.

A. magnitude of dissonance B. schemata C. irrelevance D. personalism

The cost of workers' compensation insurance for the employer does not depend on

a. the number of employees; b. the riskiness of the jobs the employees perform; c. the company's accident history; d. the amount of FICA, FUTA, and SUTA taxes due; e. any of these.

Under ________, the market consists of many buyers and sellers trading in a uniform commodity

A) pure competition B) monopolistic competition C) oligopolistic competition D) a pure monopoly E) the dominant firm model

A credit to the Factory Overhead account represents actual overhead costs

Indicate whether the statement is true or false