The Laffer curve indicates which of the following?

A. There is an ideal tax-revenue-maximizing tax rate for government taxes.

B. There is an ideal interest rate that will maximize investment spending.

C. There is an ideal income tax rate on individuals, depending on their consumption behavior.

D. There is an ideal amount of government spending that will lead to full national employment.

Answer: A

You might also like to view...

On the gold standard, a trade deficit in the U.S. impacted the economy by producing

(a) a gain of specie. (b) a tight supply of money. (c) low interest rates. (d) deflation.

A new public offering that significantly shifts the supply curve for a firm's shares will

a. have no impact on the stock's price b. decrease the stock's price c. increase the stock's price d. decrease the value of the firm's previously issued bonds e. decrease the firm's working capital

An event that changes the supply of any factor of production can alter the earnings of all the factors

a. True b. False Indicate whether the statement is true or false

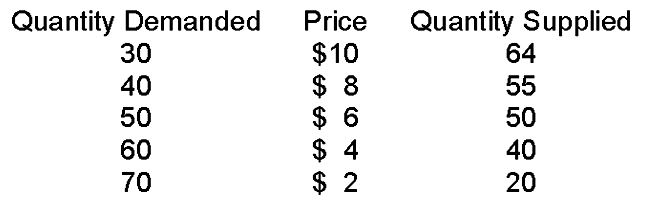

If the government set a price ceiling at $8

A. there would be a temporary surplus, then prices would fall to equilibrium.

B. there would be a permanent surplus, at least until the price floor was lifted.

C. the price would fall back to the equilibrium price.

D. the price floor would not have any effect on this market.