Which of the following is not a valid point in debating the merits of increasing government expenditures or cutting taxes during a recession?

a. A cut in the marginal tax rate increases the incentives to find a job and work longer hours.

b. Consumers will save a portion of a tax cut.

c. The government may use the increase in expenditures on projects with little value, particularly if it wishes to respond quickly.

d. There is no evidence that tax cuts have been followed by increases in economic growth.

d

You might also like to view...

Changes in which of the following do NOT shift the AS curve? i. the price level ii. potential GDP iii. the money wage rate

A) i only B) ii only C) iii only D) i and ii E) i, ii, and iii

Given the scenario described, if the market price of hammers increased from $8 to $11:

Assume there are three hardware stores, each willing to sell one standard model hammer in a given time period. House Depot can offer their hammer for a minimum of $7. Lace Hardware can offer the hammer for a minimum of $10. Bob's Hardware store can offer the hammer at a minimum price of $13. A. total producer surplus would increase to $5. B. total producer surplus would decrease to $1. C. total producer surplus would increase to $17. D. total producer surplus would decrease to $7.

How can government policy stimulate economic growth?

a. increasing spending on Social Security payments b. decreasing spending on research and development forcing it to be more efficient c. increasing research and development of new technology d. decreasing spending to end the budget deficit

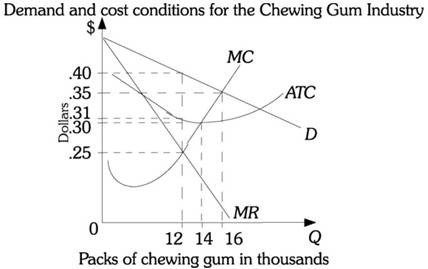

Refer to the information provided in Figure 14.1 below to answer the question(s) that follow. Figure 14.1Refer to Figure 14.1. Six firms that produce chewing gum form a cartel. The cartel faces the market demand curve given by D. To maximize profits, the cartel should produce ________ packs of chewing gum and the price should be ________.

Figure 14.1Refer to Figure 14.1. Six firms that produce chewing gum form a cartel. The cartel faces the market demand curve given by D. To maximize profits, the cartel should produce ________ packs of chewing gum and the price should be ________.

A. 12,000; $.40 B. 16,000; $.35 C. 12,000; $.25 D. 14,000; $.30